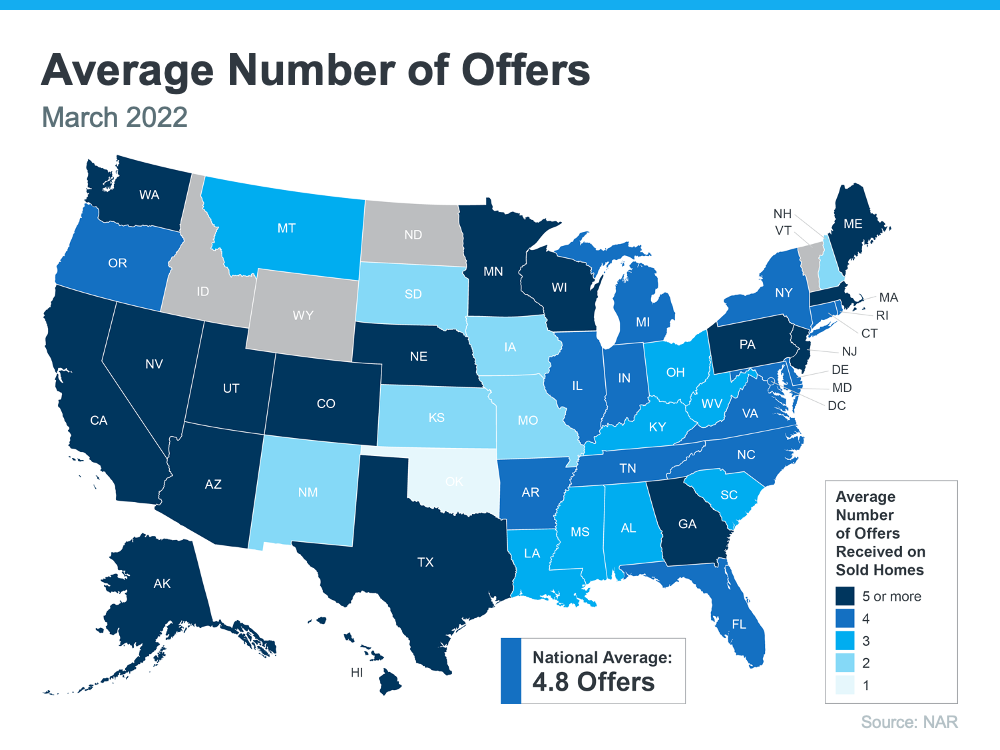

With a limited number of homes for sale today and so many buyers looking to make a purchase before mortgage rates rise further, bidding wars are common. According to the latest report from the National Association of Realtors (NAR), nationwide, homes are getting an average of 4.8 offers per sale. Here’s a look at how that breaks down state-by-state (see map below):

The same report from NAR shows the average buyer made two offers before getting their third offer accepted. In this type of competitive housing market, it’s important to know what levers you can pull to help you beat the competition. While a real estate professional is your ultimate guide to presenting a strong offer, here are a few things you could consider.

Offering over Asking Price

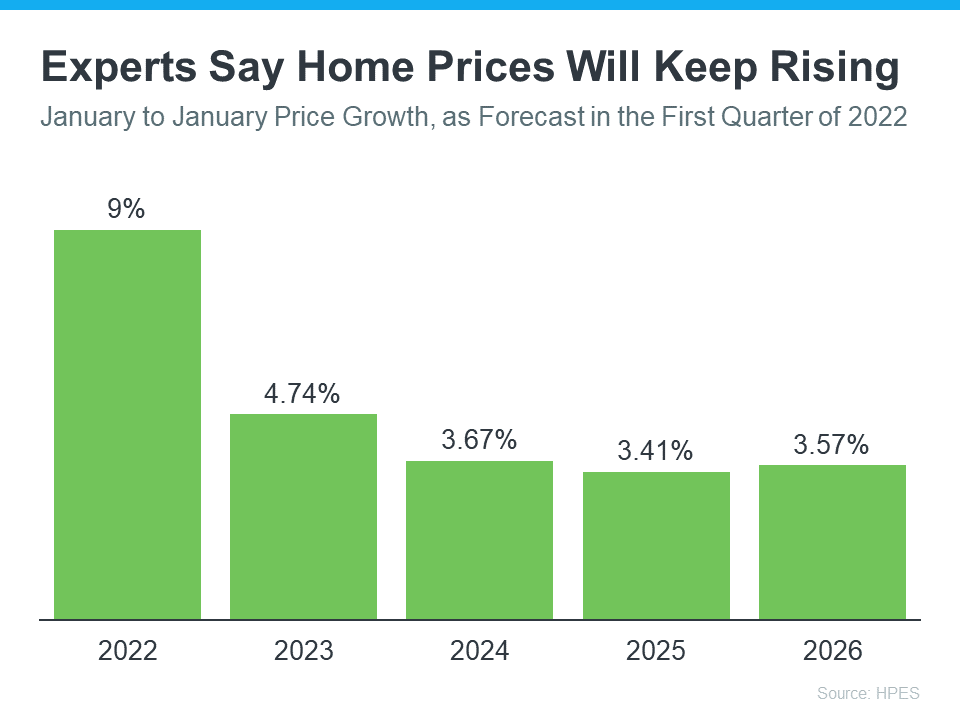

When you think of sweetening the deal for sellers, the first thought you likely have is around the price of the home. In today’s housing market, it’s true more homes are selling for over asking price because there are more buyers than there are homes for sale. You just want to make sure your offer is still within your budget and realistic for the market value in your area – that’s where a local real estate professional can help you through the process. Bankrate says:

“Simply put, being willing to pay more money than other buyers is one of the best ways to get your offer accepted. You may not have to increase it by a lot — it’ll depend on the area and other factors — so look to your real estate agent for guidance.”

Putting Down a Bigger Earnest Money Deposit

You could also consider putting down a larger deposit up front. An earnest money deposit is a check you write to go along with your offer. If your offer is accepted, this deposit is credited toward your home purchase. NerdWallet explains how it works:

“A typical earnest money deposit is 1% to 2% of the home’s purchase price, but the amount varies by location. A higher earnest money deposit may catch a seller’s attention in a hot housing market.”

That’s because it shows the seller you’re seriously interested in their house and have already set aside money that you’re ready to put toward the purchase. Talk to a professional to see if this is something you can do in your area.

Making a Higher Down Payment

Another option is increasing how much of a down payment you’re going to make. The benefit of a higher down payment is you won’t have to finance as much. This helps the seller feel like there’s less risk of the deal or the financing falling through. And if other buyers put less down, it could be what helps your offer stand out from the crowd.

Non-Financial Options To Make a Strong Offer

Realtor.com points out that while increasing these financial portions of the deal can help, they’re not your only options:

“. . . Price is not the only factor sellers weigh when they look at offers. The buyer’s terms and contingencies are also taken into account, as well as pre-approval letters, appraisal requirements, and the closing time the buyer is asking for.”

When it’s time to make an offer, partner with a trusted professional. They have insight into what sellers are looking for in your local market and can give you expert advice on what levers you may or may not want to pull when it’s time to write an offer.

From a non-financial perspective, this can include things like flexible move-in dates or minimal contingencies (conditions you set that the seller must meet for the purchase to be finalized). For example, you could make an offer that’s not contingent on the sale of your current home. Just remember, there are certain contingencies you don’t want to forego, like your home inspection. Ultimately, the options you have can vary state-to-state, so it’s best to lean on an expert real estate professional for guidance.

Bottom Line

In today’s hot housing market, you need a partner who can serve as your guide, especially when it comes to making a strong offer. Let’s connect so you have a trusted resource and coach on how to make the strongest offer possible for your specific situation.

![Give Your Curb Appeal a Boost Before You Sell [INFOGRAPHIC] | Simplifying The Market](https://files.simplifyingthemarket.com/wp-content/uploads/2022/04/26113033/20220429-MEM.png)

![Myths About Today’s Housing Market [INFOGRAPHIC] | Simplifying The Market](https://files.simplifyingthemarket.com/wp-content/uploads/2022/04/21104831/20220422-MEM.png)